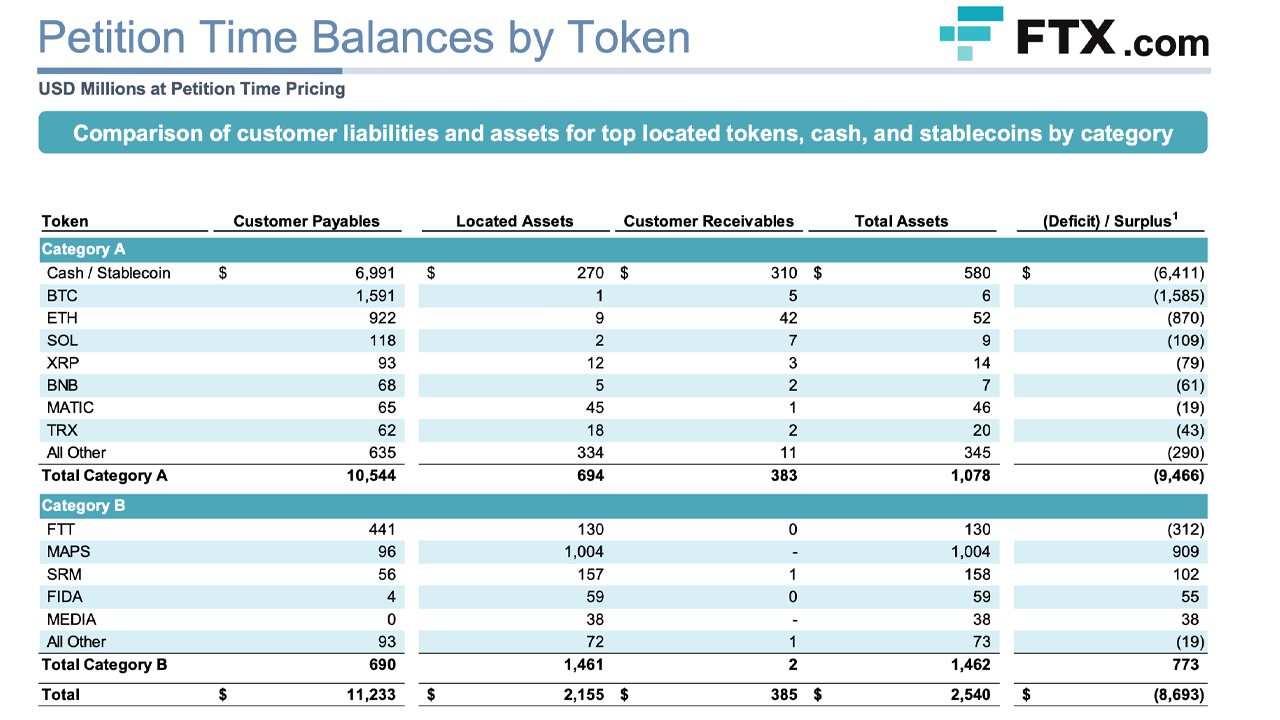

On March 2, 2023, FTX creditors revealed their second stakeholder presentation, which contains a preliminary examination of the now-defunct crypto trading platform’s deficits. The recent presentation uncovers a considerable shortfall, as roughly $2.2 billion of the firm’s total assets were located in FTX-related addresses, but just $694 million is considered “Category A Assets,” Or liquid digital assets like bitcoin, tether or ethereum. Additionally, John J. Ray III, FTX’s present CEO, said that the firm’s attempts have been substantial, and he added that the company’s funds were “highly commingled.”

A Summary of What Contributed to FTX’s $8.9 Billion Deficit

CEO and FTX creditors John J. Ray III have released a comprehensive presentation documenting FTX’s shortfalls. The Initial report alludes to a cyber attack that occurred the day after FTX was placed under Chapter 11 bankruptcy protection November 11, 2022. In A now-deleted Telegram Chat channel, FTX US general counsel Ryne Miller The exchange was described as being hacked, and the platform was viewed as unreliable. The The cyber attack was the subject of initial deficit analysis.

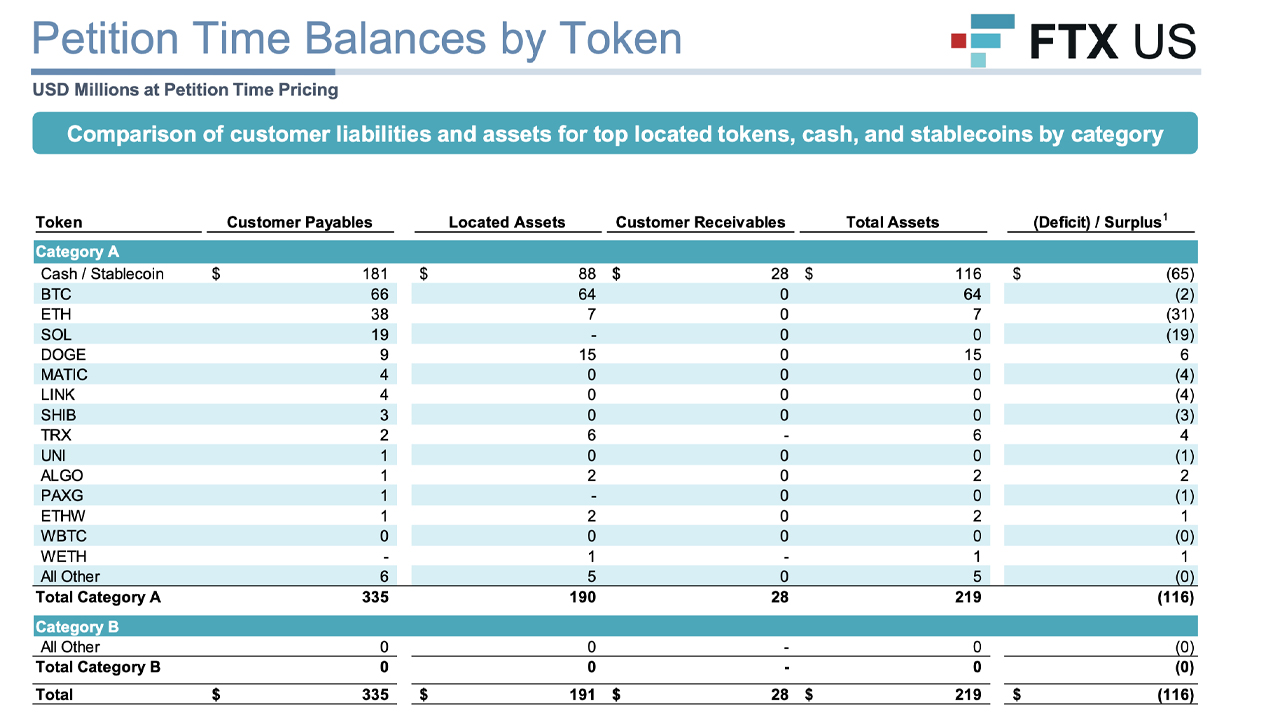

The The report mentions that both FTXUS and FTXUS commonly had digital assets in sweep accounts that weren’t segregated for individual customers. The creditors noted that due to the cyber attack, the firm’s computing environment was secured and “remains subject to certain restrictions,” Limiting access to crucial data The report categorizes FTX’s holdings into two groups: “Category A Assets,” Which have bigger market caps or trading volumes “Category B Assets,” that do not meet the liquidity standards Category A Assets.

In spite of recognizing all assets, there is still an $8.9 Billion deficit. “There is a substantial shortfall at the FTX.com exchange at the time of the petition, defined as the difference between digital asset claims on the FTX.com ledger and digital assets available to satisfy those claims,” The report says. “The shortfall is particularly large for Category A Assets. Just a small sum of cash, stablecoin, [bitcoin], [ethereum], and other Category A Assets remain in wallets preliminarily connected with the FTX.com exchange.”