The amount of Ether in circulation has reached its highest level of the year. On Wednesday, the Annualized EIP-1559 Burn Rate ETH exceeded the Issuance Rate by 1.425%, the greatest disparity since it began in May. The deflation rate has now risen above 17% in a single day.

As the deflation rate rises, each ETH token becomes scarcer faster. Most analysts think this should eventually lead to an increase in the cryptocurrency’s price.

The near-5.0% drop in ETH/USD on Friday, following reports that crypto bank Silvergate and Tether may have committed fraud to maintain their access to the global banking system, suggests that traders are not paying attention to the recent developments in ETH deflation. The currency is currently trading at around $1,570, about 10% lower than it was at its mid-$1,700 highs earlier this month.

It seems that the deflation rate is trending upwards, and traders should remember this as a potential talking point/narrative that could help ETH gain later in the year. Other themes that could be driving the currency include network upgrades such as staked ETH withdrawals and a possible resurgence of DeFi, as well as the possibility of a macro backdrop improvement if the US can avoid a recession and benefit from lower inflation rates due to the Federal Reserve’s ability to reduce rates.

Explainer – What is Driving the Increase in ETH Deflation?

Before we can answer the question about what is driving the rise in ETH deflation rate, we must first understand how it works. The Ethereum Network fee structure involves two components. Firstly, a fee is charged to all users in order for their transaction to be accepted and processed on the Blockchain. Secondly, users can also choose to pay a voluntary tip to expedite their transactions. The Ethereum Network automatically calculates the base fee, which increases during heavy network traffic.

Ethereum Improvement Proposal (EIP-1559, which was integrated into the Ethereum Code in July 2020) is a major factor contributing to deflation. This is a mechanism that burns ETH every time a transaction is made. This is done by “burning” a portion of the network fees collected each time a transaction is processed. The ETH burned is permanently removed from circulation, effectively reducing the total ETH supply.

In summary, the surge in the ETH deflation rate is being driven by a combination of the growing popularity of the Ethereum Network and the implementation of EIP-1559.

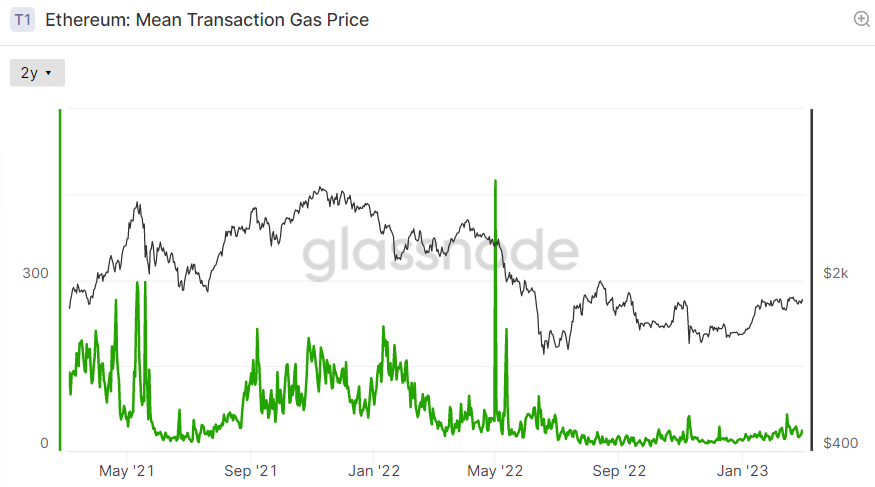

The London hardfork scheduled for August 2021 will imply that all user fees are burned, which will permanently remove tokens from circulation. This consequently increases the rate at which Ether increases. When the burn rate is higher than the ETH issuance rate, the ETH supply is expected to decrease by 0.55%. ETH is distributed to nodes and stakers that secure the Ethereum network. The chart below displays how Ethereum network fees have been rising steadily in the past few months.

ETH Deflation Rate Could Speed Up

High network demand pushed the daily average ETH (EIP1559) burn rate to 6.0% in early 2022, when the Ethereum network was still powered by the energy-intensive proof of work consensus mechanism. This was due to the higher energy fees and miner costs that miners incurred to power the network. Ethereum’s issuance rate was much higher at around 4.4-4.6% annually.

This suggests: The Ether deflation rate only hit a maximum of approximately 1.5%. If the DeFi and crypto markets expand, the EIP1559 burn rate could return to its early 2022 levels, which is much lower than the new ETH issuance rate. This could result in Ether’s deflation rate reaching 5.5%.

Where is the ETH Price Headed Next?

Although ETH deflation might sound exciting, bullish investors should be patient as the short-term outlook for the second-largest cryptocurrency by market capitalization looks uncertain. ETH’s latest drop has breached an uptrend that had been in place since the beginning of 2023.

This could be unfavorable for Ether’s near-term price outlook, with a possible test of February lows in the mid-$11,400s. Of course, if the strong rally in US stock markets on Friday continues into next week, it could help prevent further declines in the crypto market. Nevertheless, ETH is likely to remain in its February mid-$1,400s to mid-$1,700s price range.