BeneathBlue/iStock Editorial via Getty Images

We’re now in March 2023, and it’s been just half a year since the last post. Ethereum (ETH-USD)has moved from a proof-of-work to a proof-of-stake system. This was a great technological achievement for Ethereum, and was welcomed by many developers. However, there was a small part of the Ethereum community that wasn’t so pleased: The miners.

Impact of the Ethereum Merge

For those who haven’t followed it closely, here’s a quick overview. Ethereum was one of the few blockchains that could be profitably mined using GPU computers, instead of the ASICs needed to mine Bitcoin (BTC-USD). This change had a direct effect on public miners such as Hut 8 Mining (HUT) and HIVE Blockchain (HIVE). They had been using GPUs to mine Ethereum.

There is a general consensus within the crypto community that these GPU machines can be put to other uses. Web3 activities are preferred to transaction processing. In addition, a small push was made to create a new proof-of-work blockchain, Ethereum PoW (ETHW – USD). This chain hasn’t gained much traction.

Some thought was given to Ethereum Classic (ETC-USD) as it is also a proof-of-work smart contracts chain. Would there be a migration of miners from Ethereum to Ethereum Classic after the merger?

Activity on Ethereum Classic

The chart below shows the mean hash rate. Ethereum Classic saw a surge right after the Ethereum merge last September. While a large part of the hash rate has decreased, it is still much higher than it was before the merger. This is theoretically beneficial, as it implies that the network is more secure, and it is harder for attackers to exploit.

Mean Hash Rate (Coin Metrics)

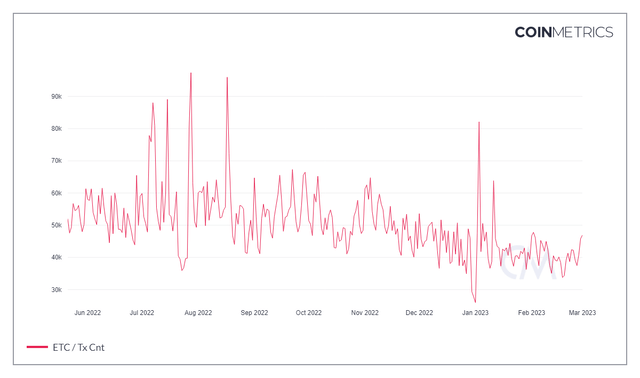

The chart below shows that there hasn’t been much economic activity on Ethereum Classic since the merger. Transactions have been steadily decreasing since September.

Transaction Trend (Coin Metrics)

Contrary to this, Bitcoin has seen an increase in its daily transactions since the beginning of September.

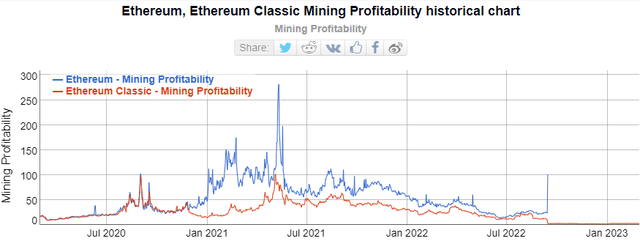

ETC Profitability (BitInfoCharts)

Without sufficient economic activity on the Ethereum Classic Blockchain, the ETC block rewards don’t have as many buyers, which could theoretically push the coin’s price down if miners decide to sell their ETC rewards to pay for their operations. As miners have seen their profitability drop by around 70% since the merger, it is likely that they are selling off their ETC rewards to cover costs.

Overall, Ethereum Classic Trust is still a good investment. The blockchain is still secure and miners are still actively competing for the block rewards. The lack of economic activity is worrying, however, and could be indicative of Ethereum Classic’s future. It is important to keep an eye on the network and its transactions to ensure that the network remains healthy and secure.

As of December 31, 2022, Grayscale’s Ethereum Classic Trust (ETCG) holds 8.5% of the circulating coins, the largest 100 wallets containing a combined 74.2% of the total. This is a significantly higher concentration than other leading proof-of-work coins such as Bitcoin (14.9%), Bitcoin Cash (34.0%), Litecoin (43.5%), and Dogecoin (67.4%). Despite this concentration of ownership, the trust’s net asset value has decreased, resulting in a current discount of 63%. The lack of meaningful network usage and the rise in mean hashrate has been particularly damaging for ETCG. If network demand for the coin increases, investors may be able to take advantage of the discount and turn a profit. However, at this stage, it’s a risky bet.