The Price of Bitcoin has been tumultuous lately due to the uncertainty surrounding Tether, the world’s most popular stablecoin. BTC dropped to the $22,000 level because of legal issues.

Meanwhile, other well-known cryptocurrencies such as Litecoin (LTC) and Dogecoin (DOGE) also experienced slight price decreases.

The recent downturns in the crypto market may be due to the release of US manufacturing data and worries about the availability of banking services for crypto firms in the US.

In this article, we will discuss the current state of the cryptocurrency sector and provide some predictions for Bitcoin’s price in the coming days.

Silvergate Uncertainty Weighs on Crypto

After the market closed on Wednesday, Silvergate filed a statement with the Securities and Exchange Commission (SEC) which stated that it was postponing the submission of its yearly reports while it evaluates the impact of a number of events on its business.

As a result, the value of Bitcoin and other digital assets dropped significantly and has since been displaying mixed signals. It is worth noting that Silvergate’s announcement has had an impact on the cryptocurrency market.

It is important to remember that Silvergate Capital (SI) revealed on Wednesday that it will be delaying its annual report submission due to losses from the November FTX crash and various regulatory investigations.

This has had a detrimental effect on market sentiment and made traders and investors anxious about the stability and security of the crypto industry, resulting in a large sell-off.

Moreover, the backlash to this announcement has led to increased regulatory oversight for the cryptocurrency industry, making it less likely for authorities to grant licenses to crypto-related businesses. This could restrict the industry’s expansion and growth.

Risk Aversion in Bitcoin Market

The global cryptocurrency market is likely to end the week with a bearish outlook due to a variety of factors. The release of strong US economic data has caused speculation that the Federal Reserve will raise interest rates in the near future.

The increased regulatory scrutiny of the cryptocurrency industry has also made investors more cautious of the risks involved with investing in digital assets, leading to heightened risk aversion in the market.

The recent dip in the price of Bitcoin has also caused some investors to become doubtful about the future of the world’s biggest cryptocurrency. The recent sell-off has caused some investors to turn bearish on the asset.

Bitcoin Price Forecast

The market is still uncertain as to where Bitcoin is headed next. The cryptocurrency market is unpredictable and there is no guarantee that the present bearish trend will continue.

Nevertheless, some analysts think that the recent bearish trend is an indication that the market is consolidating before the next big move. If this turns out to be the case, then the cost of Bitcoin could be on its way to the $25,000 mark in the near future.

In general, the cryptocurrency market is still going through a great deal of volatility and uncertainty. It is hard to predict where Bitcoin will go in the coming days.

It remains to be seen whether the recent sell-off is a sign of a larger trend or just a short-term correction. Investors should proceed with caution and pay close attention to the market for any signs of a potential recovery or further losses.

Federal Reserve As a response to persistent inflationary pressures, the Federal Reserve might be more aggressive when it comes to raising the interest rates.

Traders Investors are monitoring the economic indicators closely in anticipation of potential rate hikes and rising inflation. The economy is doing well, and since inflation pressures are still present, it is likely that the Federal Reserve will increase its policy rate to an even higher level than previously predicted in late 2013.

Bitcoin Price

The current value of Bitcoin is $22,357. It has a 24-hour trading volume of $18.5 billion. This is a 0.2% decrease in worth compared to the past 24 hours. Similarly, Ethereum trades at $1,570, and its 24-hour trading volume is $6.7 billion. The price has dropped by 0.15 percent in the last 24 hours.

Technical analysis suggests that the BTC/USD pair could break the symmetrical triangle pattern at $23,250. In this case, the Bitcoin price could drop to the $22,046 support area. If it goes below the support zone, it might sink even further to $21,450.

The presence of a bearish-engulfing candle indicates a strong selling push. However, there may be a bullish bounce-off if the candles close above $22,800.

Purchase BTC Now

Alternative Cryptocurrencies

If you are looking to invest in something else with higher long-term growth potential, then it is possible to consider other options.

Cryptonews did a comprehensive analysis of the top 15 cryptocurrencies that investors should watch out for in 2023. Click on the link to learn more.

Disclaimer: The Industry Talk This section contains insights from crypto industry professionals and is not part of the editorial content. Cryptonews.com.

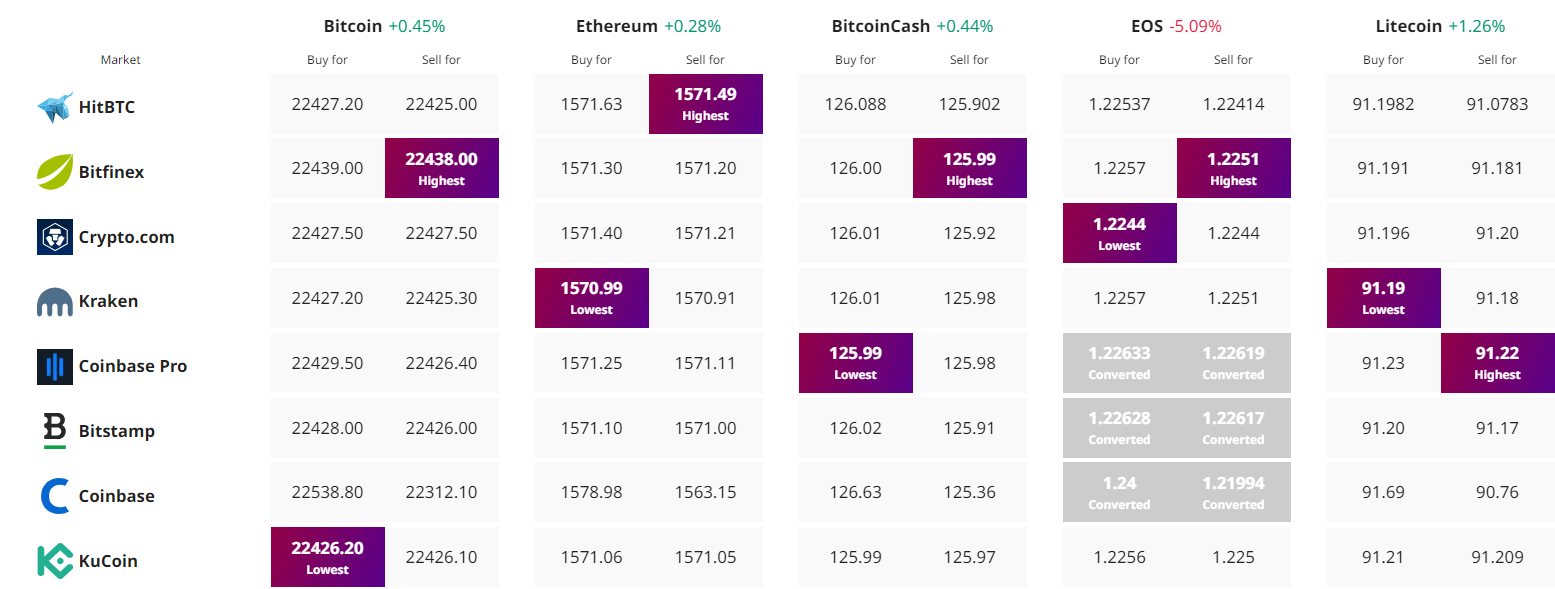

Discover The Best Price To Buy/Sell Cryptocurrency