Riot Platforms (NASDAQ: RIOT) has seen its stock price continue its sell-off, even as Bitcoin and other cryptocurrencies hold steady. The shares have dropped to as low as $8.90 on Tuesday, the lowest level since April 6th. It has now fallen by more than 56% from its highest point this year, putting it firmly in a deep bear zone.

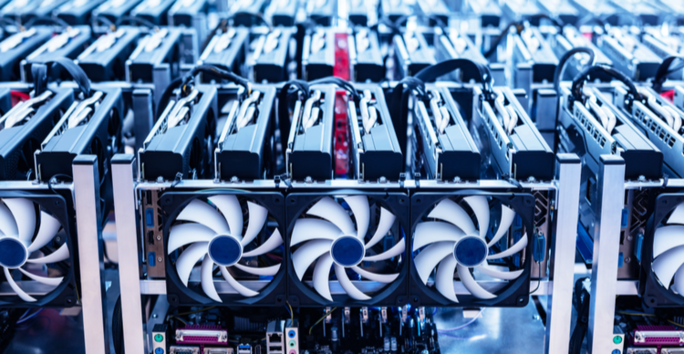

Riot Platforms is a major player in the Bitcoin mining industry. The company runs some of the biggest mining rigs in the world, such as its Rockdale facility, the largest mining and hosting facility in North America, with a deployed hash rate of 10.7 EH/s.

Generally, Riot Platforms and other mining companies like Marathon Digital, Cipher Mining, and Argo Blockchain tend to benefit from a rising Bitcoin price. This explains the surge in their shares when Bitcoin peaked at $32,000 earlier in the year.

It is surprising then, that Riot Platforms’ stock price has dropped even as Bitcoin has done well over the past few weeks. The cryptocurrency has remained above $26,200, while the fear and greed index is now in the extreme fear zone of 25. The Dow Jones, Nasdaq 100, and S&P 500 have also been falling significantly recently.

I believe that Riot Platforms and Marathon Digital offer good speculative buying opportunities. Bitcoin’s halving in 2024 is likely to push the price up, and the SEC is close to approving a spot Bitcoin ETF, with big players like Blackrock, Fidelity, and WisdomTree involved in the application process. Also, Bitcoin has held strong despite the Federal Reserve increasing interest rates to the highest point in more than two decades.

The daily chart for RIOT shows that its share price has been in a strong downtrend over the past few months. It recently fell below the key support at $14.45, the highest point in April this year. The stock has now dropped below the key support at $10.07, the lowest point on August 25th. The 50-day and 200-day weighted moving averages (WMA) are also close to forming a death cross, meaning the stock will remain underwater for some time. If this occurs, the next level to watch out for is $8.