The value of Bitcoin has surged in various regions, particularly those experiencing significant devaluation of their fiat currencies. Turkey, for example, saw a nearly 70% increase in inflation in January and a 1.3% rise in BTC prices compared to global rates in July. Meanwhile, South Korea has experienced an astonishing 10.23% increase in Bitcoin’s value.

On March 6, fiat currency exchange rates in Egypt and Turkey dropped as their central banks attempted to combat inflation. In contrast, strict foreign exchange controls in South Korea have led to a boost in cryptocurrency trading among local investors.

The Impact of the Lira’s Decline on Crypto Adoption

In Turkey, inflation reached 67.07% in January, causing concerns about continued rate hikes. The Turkish Lira has also depreciated by over 40% against the US dollar in the past year. The Turkish Finance Minister, Mehmet Simsek, predicts that inflation will remain high in the coming months. This decline of the Lira previously led to a 1.3% increase in the premium for Bitcoin. In January, Simsek announced that the government is close to finalizing regulations for cryptocurrencies.

In response to these developments, crypto exchange OKX recently launched a platform specifically for Turkish clients. This launch includes the availability of Turkish Lira trading pairs for Bitcoin and Ethereum. Ray Youssef, CEO of Noones App, sees this as a positive step towards addressing issues faced by regions like Egypt and the Global South through peer-to-peer trading.

“Egypt just got twice as poor in a SINGLE day! And crypto is 100% illegal there. To all the central banks in the world and to all the people of the Global South, listen well: your central banks are not solely responsible for your pain, they are being attacked by the colonial west! Crypto is not the enemy, but when used in peer-to-peer markets, it is our ONLY solution!” Youssef stated.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

In light of Turkey’s history of crypto money laundering, authorities may consider limiting foreign investment in local crypto exchanges to help offset the weakness of the Lira. This could result in more Bitcoin circulating domestically at a premium to the global spot price.

South Korea’s “Kimchi” Premium Protects Local Currency

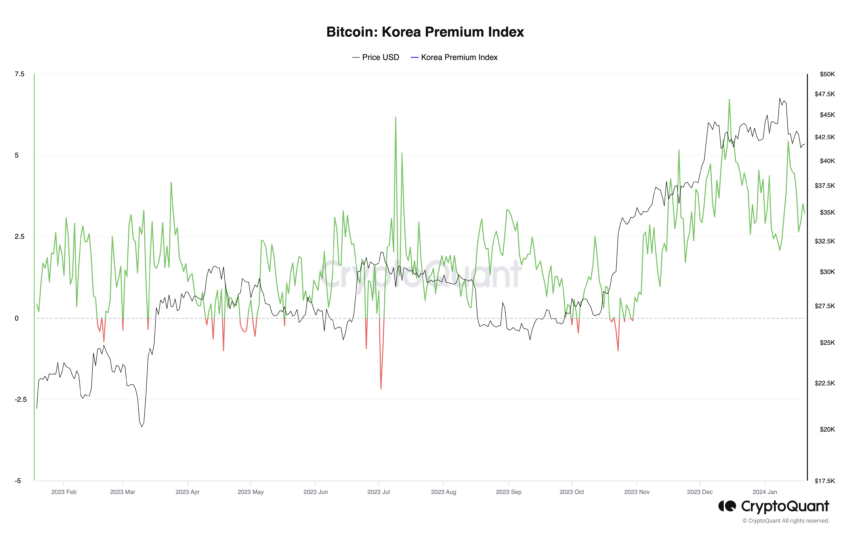

In South Korea, the government restricts foreign exchange flows into the cryptocurrency market. As a result, the region’s “Kimchi premium” has seen a 10% increase following the recent Bitcoin rally, where the asset’s value exceeded global prices.

Foreigners are not allowed to invest in local crypto exchanges, and locals are prohibited from engaging in crypto arbitrage trading to take advantage of the local premium. This has resulted in all cryptocurrency remaining within the country, with the premium indicating strong buying pressure in the local market.

The Kimchi premium has consistently occurred during Bitcoin market peaks. For example, earlier this week, Bitcoin briefly reached a value of $69,000 before dropping over 3%, coinciding with a surge in the Kimchi premium. Similarly, eight months prior, Bitcoin was trading nearly 3% higher on Bithumb, Korea’s largest exchange, with the 14-day moving average of the Korean Premium Index similar to its value during the peak of the 2021 Bitcoin cycle.

Read more: What Is Fiat Currency? How Does It Differ From Cryptocurrency?

Following this news, BeInCrypto reached out to Bithumb for comment on the Kimchi premium but did not receive a response by the time of publication. Bithumb is currently the largest crypto trading platform in South Korea.

Disclaimer

All information presented on our website is published in good faith and for general informational purposes only. Readers should use their own discretion when taking action based on the information found on our website.