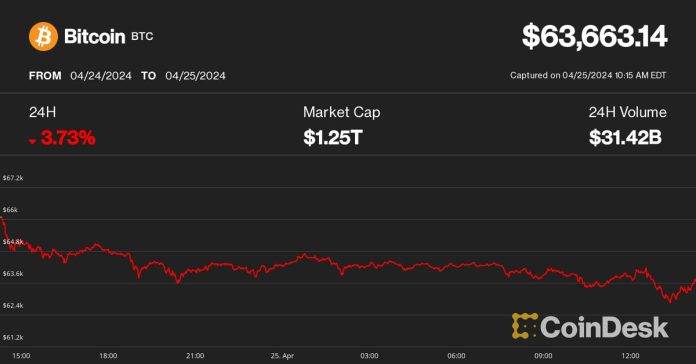

On Thursday, Bitcoin (BTC) briefly dropped below $63,000 as the wider cryptocurrency market faced a downturn. This came after new data revealed higher inflation and slower growth in the U.S. during the first quarter.

According to the U.S. government’s preliminary report, first quarter GDP only grew by 1.6%, significantly lower than the estimated 2.5% and a decline from 3.4% in the fourth quarter of 2023. The GDP price index also exceeded expectations, coming in at 3.1% and up from 1.6% in the previous quarter.

This disappointing inflation data caused concern among investors, leading to a decrease in risk assets across all markets. Major U.S. stock indexes, such as the S&P 500 and Nasdaq, opened the trading session with a nearly 2% drop. In addition, the 10-year U.S. Treasury bond yield rose by 8 basis points to 4.73%, reaching its highest level since November.

At one point, BTC saw a 4% decrease, hitting a low of $62,800 before recovering to $63,700. Ether (ETH) also experienced a 4% drop during this time, trading at around $3,100.

The altcoin market saw even larger declines, with major coins like Solana (SOL), Avalanche (AVAX), and Aptos (APT) falling by 8%-9% before slightly recovering. The overall cryptocurrency market also saw a decline, with the CoinDesk 20 Index (CD20) dropping by 6%.