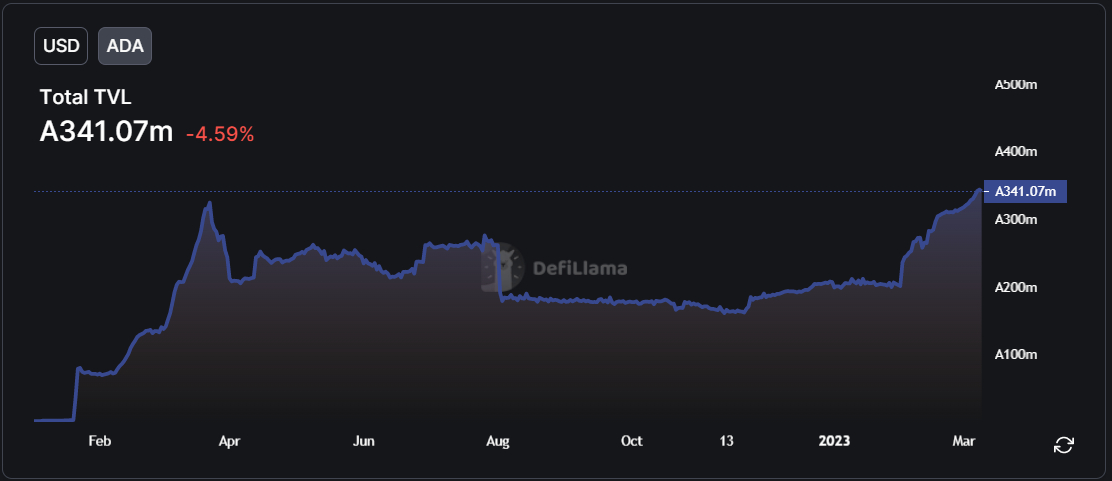

The ADA-denominated amount of cryptocurrency secured by smart contracts on the Cardano blockchain recently hit a new peak of 341 million ADA, according to figures presented by DeFi Llama. ADA is the token that drives Cardano’s high-performance blockchain, which is enabled by smart contracts and is seen as a rival to Ethereum.

The ecosystem got a boost earlier this year with the launch of Djed, an over-collateralized algorithmic stablecoin, which has opened up new yield farming opportunities in the Cardano DeFi ecosystem. The circulating supply of Djed is currently around 2.1 million, while the protocol has a reserve ratio of 471%, according to the project’s website.

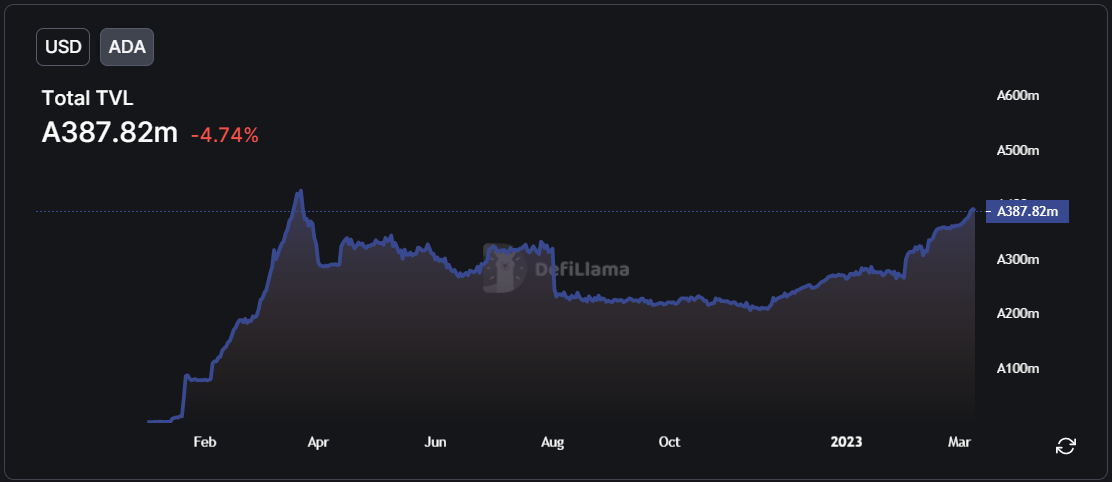

When tokens that are involved in Staking, Pool2 protocols, Borrows, Liquid Staking and Vesting are taken into account, Cardano’s “trade value locked” (TVL) amount rises to over 387 million, worth over $120 million at the current market price. However, this is still slightly lower than its all-time high from earlier this year.

USD-denominated TVL Still Far from 2022 Highs

Despite the recent upturn in the ADA-denominated value of Cardano’s TVL, a sharp fall in the USD-denominated price of ADA in the last few weeks means that the USD-denominated TVL on the Cardano blockchain is still well below its highs from early 2022. The highest TVL Cardano ever saw was over $430 million around 12 months ago.

At that time, Cardano’s price was closer to $1.0 per token. As of the time of writing, ADA/USD is trading just above $0.31, down around 90% from its all-time highs, and down 25% since finding solid resistance in the $0.42 area in early February.

The cryptocurrency’s steep drop in the last few weeks is due to broader crypto market weakness caused by the strength of the US dollar, US yields and weakness in equities as traders price in a more hawkish Fed tightening outlook for the year. Crypto-specific issues are also affecting the market, such as the recent downfall of crypto-friendly Silvergate Bank and ongoing worries about a regulatory crackdown in the US.

Where Next for Cardano (ADA)?

Cardano’s drop this week means the cryptocurrency has dropped below all of its major moving averages. In addition, the cryptocurrency now appears to be in a downtrend that goes all the way back to June 2022. ADA/USD’s failure to break decisively above its 200-Day Moving Average last month is another sign that there wasn’t enough momentum for a significant positive shift in the near-term price outlook.

Technically speaking, the outlook for the cryptocurrency is not looking good in the near term, with a fallback under $0.30 looking highly likely. This could lead to a drop back to late-2022 lows in the $0.24 area, a further 24% decline from current levels. However, given that the 14-Day Relative Strength Index (RSI) is approaching oversold territory, it probably won’t be a straight line lower as it has been in the last few weeks.

Cardano (ADA) Alternatives to Consider

Cardano’s near-term outlook looks bearish, with a high risk of further near-term losses. Investors looking for better, shorter-term coins may want to diversify their holdings with some presale tokens that have a great risk-reward – indeed, whilst presales are risky (as all crypto is), crypto investors that have historically secured the best returns are those who got in early on a presale. In the list below, we’ve reviewed the top 15 cryptocurrencies for 2023, as analyzed by the Cryptonews Industry Talk team.

The list is updated weekly with new altcoins and ICO projects.

Disclaimer: The Industry Talk section features insights by