Stock markets opened in the red following the latest company earnings reports from some of the world’s largest corporations, including Microsoft. The tech giant’s latest earnings call was seen as disappointing, and figures from companies like Boeing, Texas Instruments and 3M were also underwhelming. Gold and silver prices dropped between 0.43% and 0.72% on Wednesday, and the cryptocurrency market slid 2.79% against the US dollar in the last 24 hours.

US recession fears rise as corporate earnings disappoint

After a bullish couple of weeks, stocks, precious metals, and cryptocurrencies all declined on January 25, 2023. As investors anticipated the upcoming US Federal Reserve meeting, the state of the US economy showed signs of distress. The US displayed notable weakness. Earnings reports from Microsoft, Union Pacific, Texas Instruments and others on Wednesday suggested the economy was not improving and added to lingering concerns about a possible US recession.

By Wednesday morning and into the afternoon, the four benchmark US stock indices: the Dow Jones Industrial Average (DJIA), the S&P 500 (SPX), the Nasdaq Composite (IXIC) and the Russell 2000 (RUT) , all dropped between 1% and 2.05%. Apart from underwhelming earnings reports from some of the nation’s largest companies, US industrial production decreased by around 0.7% in December 2022.

Industrial production also declined in November 2022, falling 0.6% year-on-year. Another surprise was that retail sales during the holiday season were also down in November and December 2022. Data shows that retail sales decreased 1.1% last month, and despite the holidays in full swing, it was the biggest drop of the year.

Precious metals and crypto assets continue to dip amid economic uncertainty

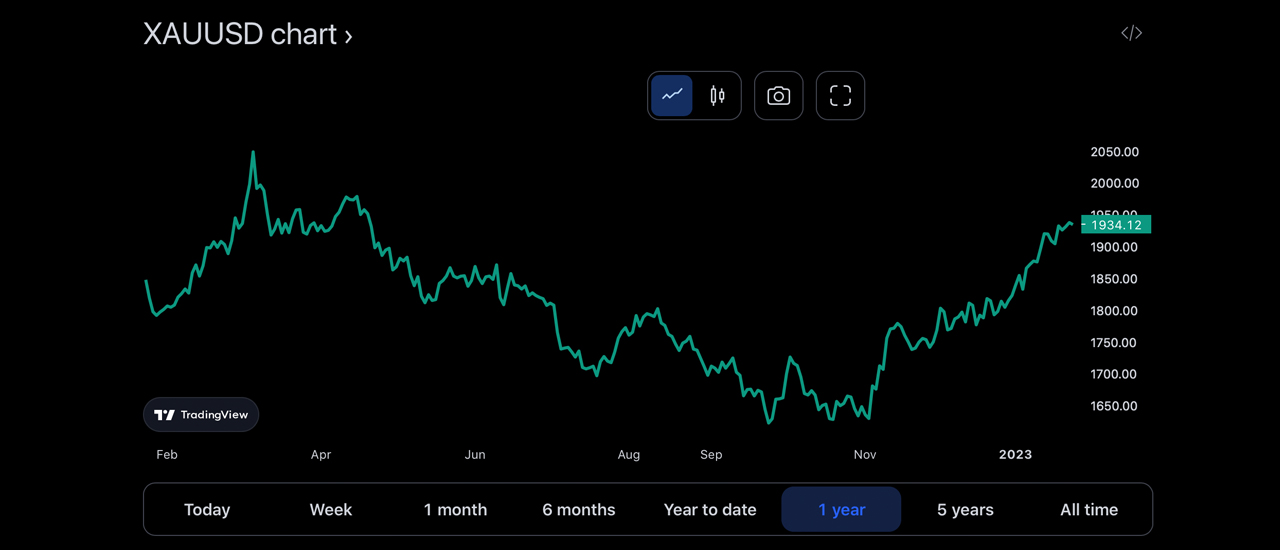

Precious metals such as gold, silver and platinum have also posted losses against the US dollar in the last 24 hours. The New York spot price on January 25, 2023 indicates that gold is trading at $1,931.70 per troy ounce, down 0.43%. An ounce of silver is down 0.72% and is trading at $23.59 per unit on Wednesday at 11 am ET. Kenneth Broux, a strategist at Société Générale, states that rising tensions in the Ukraine, weak company earnings and recession fears are weighing on investors.

“The market is certainly worried about slowing earnings growth, especially in technology, so there has been a sense that the market wants to continue to sell technology and dollars,” Broux said Wednesday. “But a major tail risk now is what happens in Ukraine, if there is an escalation in the conflict and how it affects the global economy.”

The cryptocurrency market is also feeling the pressure of the weak US economy and corporate earnings reports. Bitcoin (BTC) is trading at $10,198.69 on Wednesday at 11 am ET, down 2.79%. Ethereum (ETH) is down 3.27%, XRP is down 4.08%, Litecoin (LTC) is down 4.14%, and Bitcoin Cash (BCH) is down 4.51%.

The crypto economy is hovering just over the $1 trillion mark, currently standing at $1,019,712,653,474, according to data released Wednesday. Cryptocurrency markets have taken a 2.79% hit across the board, with Bitcoin (BTC) losing 1.49% since Tuesday. Ethereum (ETH) has dropped even further, with a 4.66% dip in value.

Global cryptocurrency trading volumes were well above $100 billion daily not long ago, however, the current global trading volume is around $55.98 billion across the entire crypto economy. Despite Wednesday’s pullback, precious metals, stocks, and crypto assets are all still doing better than they were last month. As of 11:30am ET on Wednesday, gold is up against the US dollar but still 0.2% lower, while silver is up 0.13%.

Kenneth Broux, a strategist at Societe Generale, said: “The earnings recession is still playing out, with the earnings-growth slowdown in December 2022, and the lackluster trip season and industrial production numbers, suggesting that US consumers are cautious. Rising tensions between Ukraine and Russia have also drawn Europe into the conflict.”

What do you think the future holds for markets and the economy? Share your opinion in the comments.