Coinbase Global (NASDAQ: COIN) may seem like a risky investment at first glance, with its stock price tripling in the past 52 weeks. Trading at a lofty valuation of 103 times free cash flows and 950 times earnings, even experienced growth investors may hesitate to jump in. However, dismissing Coinbase as an overvalued crypto stock could be a serious mistake. Here are two reasons why investing in Coinbase could be a smart move.

1. Running a Sophisticated Business

While Coinbase’s stock may be expensive at the moment, the same cannot be said for the crypto market. With cryptocurrencies like Bitcoin (CRYPTO: BTC) and Ethereum (CRYPTO: ETH) gaining 138% and 85% respectively in the past year, altcoin prices are also soaring. Coinbase has seen a 270% return over the same period. However, it’s important to note that holding these digital assets does not create value for the company. Instead, Coinbase generates revenue through transaction fees, offering rewards for blockchains, and subscription services. This makes it more akin to a bank that deals with various financial assets, rather than being solely reliant on cryptocurrency prices.

2. This Crypto Cycle is Different

The crypto market has experienced numerous booms and busts since its inception. However, this time could be different. With the recent approval of Exchange-traded Funds (ETFs) tied to cryptocurrencies, the industry is now in the spotlight. This has led to a significant increase in trading volumes, benefiting Coinbase as the most trusted partner for nine out of 11 approved ETFs. Additionally, with ETFs using third-party custodian services for executing trades and storing crypto assets, Coinbase stands to earn revenue from custody, trading, and financing.

Furthermore, as more institutions begin to hold crypto as part of their diversified portfolio, the financial system is officially adopting cryptocurrencies. This bodes well for Coinbase’s future revenue growth.

Coinbase’s Rising Value

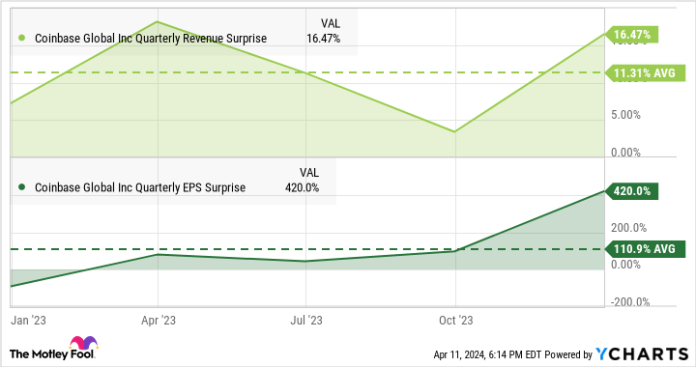

Despite its current high valuation, Coinbase’s stock looks relatively cheap when considering its potential for future growth. Trading at 12 times average revenue estimates and 108 times projected earnings, the company has a history of exceeding analyst estimates. With a unique collection of growth-inducing factors, including the current halving cycle and the recent surge in ETFs, Coinbase’s stock price could look even more attractive within the next 12-18 months.

In Conclusion

Investing in Coinbase now could prove to be a profitable decision in the long run. With the potential for significant growth and a strong foothold in the crypto market, buying Coinbase stock could be a smart move for investors.

Before jumping in, it’s important to note that The Motley Fool’s Stock Advisor team has identified 10 other stocks that they believe could provide even higher returns in the next few years. However, for those interested in investing in Coinbase, there’s no need to wait. The company has already proven its potential for growth and could continue to do so in the future.

Anders Bylund, a writer for The Motley Fool, has positions and recommendations in Bitcoin, Coinbase Global, Ethereum, and Solana. The Motley Fool has a disclosure policy.