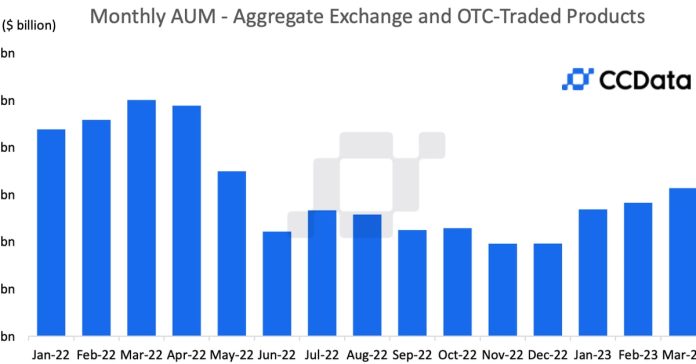

For the fourth straight month, the amount of money invested in digital currency products rose in March. According to data from CryptoCompare, cryptocurrency prices have continued to rise.

The assets under management grew to $13.4 billion, a 10.9% increase from February when the total was the lowest it had been since November 2022 when the FTX crypto exchange collapsed.

Products based on Bitcoin saw a 14% rise to $22.7 billion. While Ethereum-related products experienced a 6.25% jump to $7.22 trillion. Bitcoin’s share of overall investment rose to 72%, reaching its highest level in nine months in mid-March. Meanwhile, the proportion of “other” crypto products decreased to 3.2% after the assets dropped 13.3% from $1 billion to $1 billion.

“The growth in Bitcoin’s market share was consistent with the surge in its dominance and the move away from altcoins as investors responded to the recent market volatility,” the report stated.

A firm that manages crypto-investment funds saw its assets grow by 20.3% to $553 million for the second month in a row. ProShares was second, with a 19.1% increase in its assets to $1.08 billion.

Grayscale Investments was the leading player with $23.6 billion in total, which is 13.2% more than it was in February of last year. Grayscale is owned by Digital Currency Group, the parent company of CoinDesk.