The past three weeks have seen an uptick in the prices of cryptocurrencies, precious metals, and stocks. Now, all eyes are on the near future and the Federal Open Market Committee Meeting FOMC, which is set to take place in 11 days. On Friday, Federal Reserve Governor Christopher Waller expressed his support for a quarter-point rate hike at the FOMC’s next meeting. Analysts believe that the markets will be heavily influenced by the results of the upcoming election and the Fed meeting.

Market Remains Firm Ahead of Fed Meeting Despite Gains in Stocks, Cryptocurrencies, and Precious Metals in 2023

On Saturday, January 21.23, the global cryptocurrency market capitalization rose 5.87%, reaching $1.06 trillion. The most popular cryptocurrency, Bitcoin (BTC), increased 11.63% relative to the US dollar in the past seven days. Ethereum (ETH) was the second most valuable asset, with the US dollar climbing 8.33% over the same period. This increase in value for the major cryptocurrencies has pushed up the value of the thousands of digital currencies below BTC/ETH.

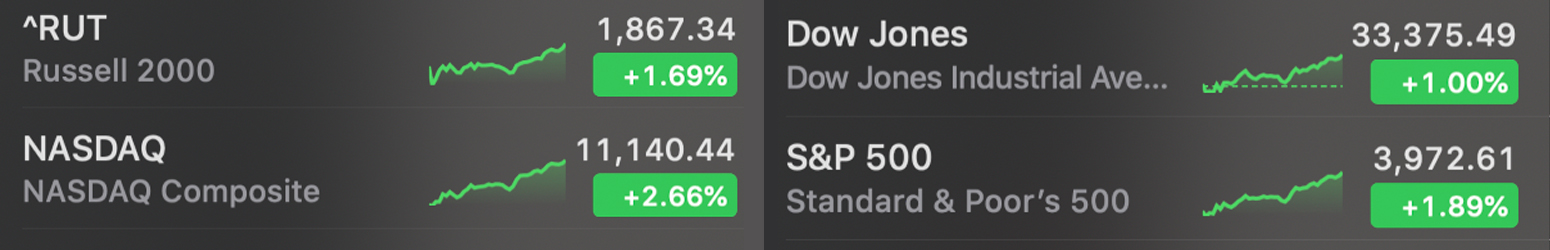

On Friday, January 20, the stock market closed the day in the green. The four major benchmark stocks (S&P 500, Dow Jones, Nasdaq And Russell 2000) all rose between 1% and 2.66% above the US dollar. The S&P 500 rose 1.89% to its highest level yet, the Russell 2000 Index (RUT) increased 1.69%, and the Dow Jones Industrial Average rose an average of 1%. This marks the second consecutive week of gains for US stocks, with the RUT small cap index gaining 7.1% in 2018, making small caps the leading share class for 2023.

Troy ounce of gold traded for $1927.30/unit, with silver trading for $24.01/ounce. Like stocks and cryptocurrencies, precious metals rallied in 2023, erasing any losses from December 2022. Gold enthusiast Peter Schiff tweeted on January 19 that the price of gold will rise throughout the next year. “Gold is now trading above $1,934, its highest price since April 2022. Gold stocks, however, have not yet reached the high of last week. In fact, gold stocks need to rise 30% from here just to get back to where they were in April

Economic and macroeconomic analysts, as well as economists, are left with an unanswered question. The Federal Open Market Committee (FOMC) meeting is expected to continue the tightening process. Heather Boushey, White House economist for the Biden Administration, told Reuters that the current leaders do not anticipate a recession.

Christopher Waller, Federal Reserve Governor, stated during a Council on Foreign Relations conference in New York that a one-time rate rise that is lower than the preceding seven is preferred. The FOMC meeting in 2022 saw seven rate increases, five with a quarter-point rise and five with a three-quarter-point increase. Waller expressed his favor of a 25 basis point hike at the next FOMC meeting and said he is looking forward to supporting further monetary policy tightening.

It is likely that the stock, precious metals, and cryptocurrency markets will respond to the news of the Fed decision. Inflation indicators will be the key determinant of the FOMC’s next meeting decision. US President Joe Biden believes the US is on the right track to recovery and tweeted about it.

How will the FOMC meeting resolve this question and what will it mean for the markets? Let us know your opinion in the comments below.