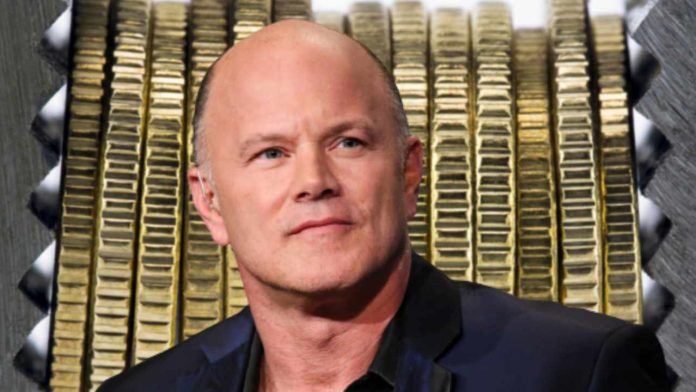

Galaxy Digital CEO Mike Novogratz has cautioned about a potential credit crunch. Noting That “we are moving towards a recession,” He anticipates that the Federal Reserve will reduce interest rates “sooner than we think.”

Novogratz on Global Credit Crunch and Recession

Galaxy Digital CEO Mike Novogratz shared his thoughts on the US Economy in an interview with CNBC on Wednesday. Comparing the present market situation to December 2018, he declared: “This reminds me a lot of 2018, December, when the Fed had this idea of one last [interest rate] hike and, of course, it sent the market into a tailspin, and they had to reverse it soon after.”

Highlighting That “data has shifted drastically” He explained it in a brief time frame:

The The oil market is signaling that the commodity market and the oil market are pointing to a recession. We There will be a credit crunch both in the US and around the world.

Novogratz stressed that Federal Reserve Chairman Jerome Powell “should pause and will be reducing rates faster than anticipated.” He added: “That’s a huge transformation in psychology. It’s got bitcoin (BTC) and ethereum (ETH) on the move.”

The executive continued: “If there was ever a moment to be in bitcoin and crypto — this is why it was created, in that governments print too much money whenever the discomfort gets too great, and we are seeing that.”

Responding To a question about his vision “the possibility of a contagion” Globally, and in the US bank system Novogratz confirmed: “There is contagion.” He noted that everyone learns from their mistakes and will eventually depend on only four or five depositories.

“I think Congress and the Fed are going to have to do something more dramatic … or we’re going to see constant pressure on these local banks and the entire system,” Novogratz said, concluding:

Now that we’ve got a market that’s going to experience a credit crunch, how do banks rebuild capital? They Don’t lend more You’re going to witness a credit crunch in the United States, and that’s beginning to be priced into the market massively.

What What do you think about these statements? Mike Novogratz? Let Let us know your thoughts in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This This article is intended for informational purposes only. It This does not constitute an offer to sell or buy, nor a solicitation for one. It also is not intended to endorse any products, companies, or services. Bitcoin.com does NOT provide advice on investment, tax, legal, and accounting matters. Neither The author and the company are not responsible for any loss or damage caused or alleged caused by the use or reliance of any content, goods, or services in this article.