Binance Thailand has partnered with Gulf Innova to launch Gulf Binance, a cryptocurrency exchange in Thailand. The platform allows users to securely buy and sell digital assets using local currency pairings. This initiative, approved by Thailand’s finance ministry in May 2023, is a significant step towards promoting crypto adoption in the region.

The global crypto industry continues to face challenges due to regulatory uncertainties. Different approaches to crypto regulation around the world have caused confusion for companies and investors. In 2022, Thailand banned the use of cryptocurrencies as a medium of payment, and digital asset business operators are prohibited from advertising or setting up payment systems using cryptocurrencies.

Despite renewed interest in regulation following the 2022 crypto crash, there is still a lack of clarity, particularly in areas such as stablecoins and custody solutions. The US Securities and Exchange Commission’s aggressive enforcement actions against major platforms like Binance and Coinbase are further complicating matters. The ongoing regulatory turf war among federal authorities is hindering industry growth and sparking discussions about the need for streamlined regulation in the US.

While other regions, such as the EU, Singapore, Japan, and the UAE, make progress with their crypto regulations, the US is lagging behind. This has led companies like Coinbase to consider relocation or international expansion.

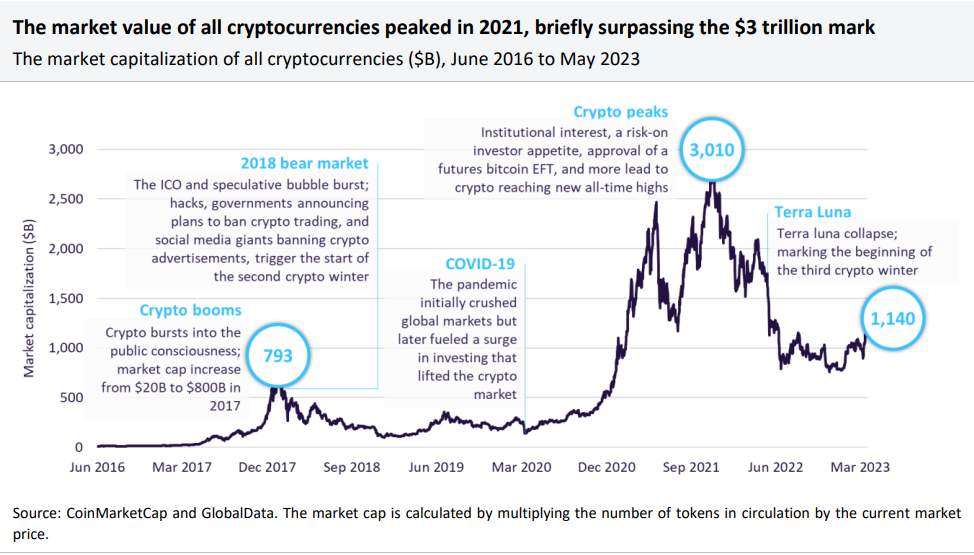

According to GlobalData’s “Thematic Intelligence: Cryptocurrencies (2023)” report, the combined value of all cryptocurrencies reached a record-breaking $3 trillion in November 2021 but dipped to $2.2 trillion by the end of 2021 due to fears of rising interest rates.

Gain access to the most comprehensive Company Profiles on the market, powered by GlobalData, and save hours of research while gaining a competitive edge. By GlobalData.

In 2022, the overall crypto market declined by 64% to below $800 billion due to unfavourable macroeconomic conditions and significant events like the Terra collapse and FTX bankruptcy. However, the market rebounded in 2023, reaching $1.1 trillion on May 16, 2023, showcasing the resilience and growth of the crypto industry.

GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets (patents, jobs, deals, company filings, social media mentions, and news) to themes, sectors, and companies, powers our signals coverage. These signals enhance our predictive capabilities, enabling us to identify the most disruptive threats across each of the sectors we cover and the companies best positioned to succeed.

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the form below.

By GlobalData

In 2022, the overall crypto market declined by 64% to below $800 billion due to unfavourable macroeconomic conditions and significant events like the Terra collapse and FTX bankruptcy. However, the market rebounded in 2023, reaching $1.1 trillion on May 16, 2023, showcasing the resilience and growth of the crypto industry.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets – patents, jobs, deals, company filings, social media mentions, and news – to themes, sectors, and companies. These signals enhance our predictive capabilities, enabling us to identify the most disruptive threats across each of the sectors we cover and the companies best positioned to succeed.

US financial regulator, the Securities and Exchange Commision’s aggressive stance on crypto enforcement is further complicating matters, with lawsuits against major platforms like Binance and Coinbase. The ongoing regulatory turf war among federal authorities is impeding industry growth, prompting discussions about the need for streamlined regulation in the US.

While other regions, including the EU, Singapore, Japan, and the UAE, progress with their crypto regulations, the US lags, leading companies like Coinbase to contemplate relocation or international expansion.

GlobalData’s Thematic Intelligence: Cryptocurrencies (2023) report found the combined value of all cryptocurrencies soared to a record-breaking $3trn in November 2021, only to dip to $2.2trn by the end of 2021 due to fears of rising interest rates.