The governor of India’s central bank, the Reserve Bank of India (RBI), has highlighted the dangers of cryptocurrency to the financial system, citing the recent US banking crisis as an example of the risks posed by digital currencies.

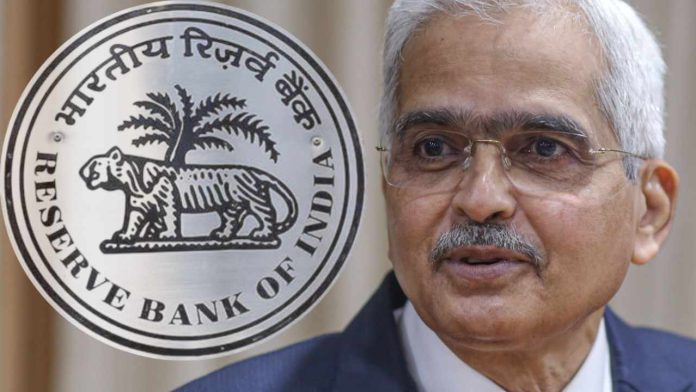

RBI Governor Highlighting Crypto Risks in Wake of US Banking Crisis

RBI Governor Shaktikanta Das recently commented on the risks of cryptocurrency while speaking at the 17th K P Hormis Commemorative Lecture on Friday. Das stated that the “ongoing U.S. banking crisis” serves to drive home the importance of robust regulators and sustainable growth, as it “clearly shows the risks of private cryptocurrencies to the financial system.”

The US banking system has been rocked by several collapses in recent weeks. Signature Bank was seized by the New York State Department of Financial Services last Sunday, while Silicon Valley Bank was closed down by regulators last Friday. Silvergate Bank also announced voluntary liquidation earlier this month.

Some have speculated that these regulatory actions are related to cryptocurrency, with Senator Elizabeth Warren (D-MA) attributing the downfall of Signature Bank to its acceptance of crypto clients without sufficient safeguards. However, regulators have insisted that their decisions were unrelated to digital currencies.

The Indian central bank governor highlighted the need for “prudent asset liability management” in the wake of the US banking crisis, adding that the “Indian economy remains resilient. The worst of inflation is behind us.”

Das has repeatedly warned about the risks of cryptocurrency, arguing that digital currencies pose a threat to India’s macroeconomic and financial stability as well as seriously undermine the central bank’s capacity to regulate the country’s monetary system.

What are your thoughts on the RBI Governor’s comments regarding cryptocurrency? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.