As the crypto bank Silvergate experiences a financial crisis, traders are turning to stablecoins for security.

Silvergate, a crypto-friendly bank based in California, is facing a customer exodus and a massive drop in its share price. It’s seen as a possible sign of insolvency. The bank has provided a variety of services tailored to crypto businesses, including funding, wiring money, and custody solutions.

Silvergate’s Struggles

Silvergate had created a name for itself in the crypto world, with a client list featuring Coinbase, Gemini, FTX, and BlockFi. It had also grown from a small regional bank to one with $12 billion in deposits by Q3 2022. However, the bank suffered a major blow following the bankruptcy of FTX, leading to repercussions even from regulators.

The news of Silvergate missing its SEC filing caused its share price to drop in half. It also led to major clients suspending business with the bank. Investors have begun to look for cash alternatives as the situation unfolds.

Moody’s Weighs In

Moody’s downgraded Silvergate’s deposit rating, causing the Exchange Network (SEN) to be suspended. This network is an important on-ramp for US crypto investors to transfer between crypto firms, so its closure has had a big impact.

Increased Focus on Stablecoins

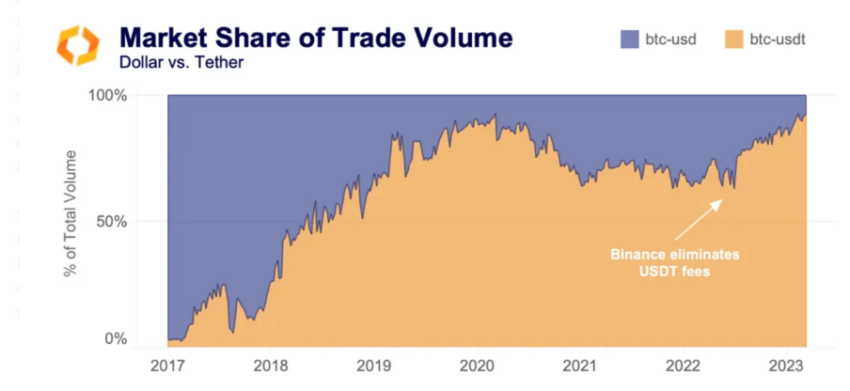

Traders have turned to stablecoins for security in the wake of this crisis. These digital assets maintain a stable value and are often pegged to the US dollar. Volume of stablecoins has been rising, and their liquidity and transparency make them attractive to investors. Stablecoins may be seen as a currency when used as a medium of exchange, and as a commodity when used as a store of value.

Regulators have been trying to deter crypto innovation, and this could be used as an example. Silvergate’s situation shows the need for diversification and the lack of clarity surrounding stablecoins.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.