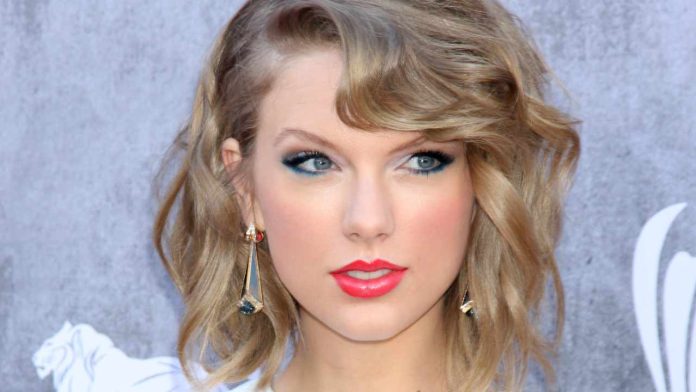

Taylor Swift, a world-renowned pop star and 12-time Grammy Award winner, reportedly declined a $100 million offer from now-bankrupt crypto exchange FTX due to concerns about unregistered securities. This news comes as a number of FTX celebrity endorsers face a class-action lawsuit, including Shaquille O’Neal (Shaq), Tom Brady, and Larry David.

How Taylor Swift Avoided a Deal With FTX

Taylor Swift, a multi-Grammy Award winner and one of the biggest names in the music industry, reportedly ran due diligence on now-bankrupt crypto exchange FTX and declined a sponsorship proposal from former FTX CEO Sam Bankman-Fried. FTX filed for Chapter 11 bankruptcy in November of last year.

Adam Moskowitz, a lawyer leading a $5 million class-action lawsuit against 16 celebrity endorsers of FTX, revealed during an episode of the Block’s Scoop podcast that Swift took the step of consulting with her lawyer when approached by SBF, unlike the other celebrities who invested in FTX.

“The one person I found that [talked to their lawyers] was Taylor Swift,” Moskowitz shared, adding:

In our discovery, Taylor Swift actually asked them: ‘Can you tell me that these are not unregistered securities?’

Bankman-Fried, who is now facing multiple fraud charges in the U.S., reportedly aggressively lobbied for a partnership with Swift, with the deal set to cost the bankrupt crypto company more than $100 million over three years.

Describing FTX as a “pyramid scheme,” Moskowitz and former Weinstein lawyer David Boies filed a class-action lawsuit in Florida alleging that the crypto exchange’s celebrity endorsers promoted a “Ponzi scheme,” impacting “thousands, if not millions, of consumers nationwide.” Shaquille O’Neal (also known as Shaq), Tom Brady, and Larry David are among the FTX celebrity promoters who are now facing a class-action lawsuit filed by Moskowitz for endorsing sales of unregistered securities.

Commenting on how Swift avoided involvement with FTX, Tesla and Twitter CEO Elon Musk, who also declined an offer from Bankman-Fried when the former FTX executive wanted to invest in Twitter, tweeted Wednesday:

I’m not surprised. Taylor is smart and her father is a well-regarded investment banker.

Scott Kingsley Swift, Taylor’s father, founded the Swift Group, a wealth management and financial advisory group that is part of Merrill Lynch, a Bank of America company. Taylor has expressed her admiration for her father’s passion for his work on several occasions. In fact, even when she was as young as eight, while her peers wanted to become astronauts or ballerinas, Taylor wanted to follow in her father’s footsteps and become a financial adviser.

What do you think of pop star Taylor Swift’s decision to be concerned about unregistered securities when approached by the disgraced FTX co-founder Sam Bankman-Fried? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, lev radin

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.