According to a recent SEC filing, Gokul Rajaram, a director at Coinbase Global Inc (NASDAQ:COIN), sold 1,145 shares of the company on March 21, 2024 for a total of $297,700 at a price of $260 per share.

Coinbase Global Inc (NASDAQ:COIN) is a digital currency exchange platform that allows merchants and consumers to transact with new digital currencies such as bitcoin, ethereum, and litecoin. The company’s platform offers users the ability to create their own cryptocurrency wallets and connect their bank accounts to buy or sell cryptocurrency. It also provides a range of services for investing, spending, saving, earning, and using cryptocurrencies.

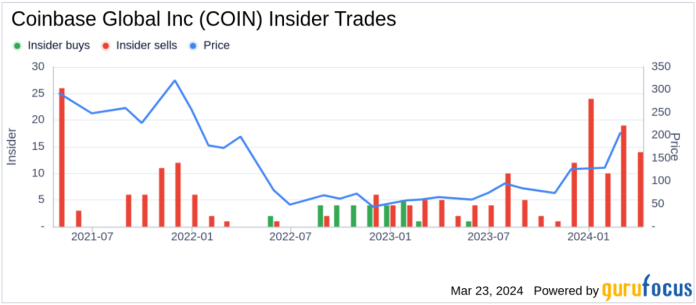

In the past year, Gokul Rajaram has sold a total of 19,465 shares of Coinbase Global Inc (NASDAQ:COIN) and has not made any purchases of the stock. This recent sale is part of a larger trend of insider transactions at the company, including 1 buy and 108 sells in the past year.

On the date of the sale, Coinbase Global Inc (NASDAQ:COIN) was trading at $260 per share, giving the company a market capitalization of $61.88 billion. The company’s price-earnings ratio is currently at 709.75, significantly higher than the industry median of 17.93 and the company’s historical median.

According to GuruFocus’s valuation model, the stock has a price-to-GF-Value ratio of 3.35 and a GF Value of $77.69, indicating that it is significantly overvalued. The GF Value takes into account historical trading multiples, a GuruFocus adjustment factor based on the company’s past returns and growth, and future business performance estimates from Morningstar analysts.

The article includes two figures showing Director Gokul Rajaram’s recent sale of shares in Coinbase Global Inc (COIN).

This article, written by GuruFocus, is not intended to provide specific financial advice and should not be considered as such. It is based on historical data and analyst projections and does not take into account individual investment objectives or financial circumstances. GuruFocus has no position in the stocks mentioned in this article.